Ahead of his appearance at tomorrow’s Travolution Summit, Kuba Zmuda, chief strategy officer at Modulr, previews research the firm has done which shows that travel firms that offer flexible and reliable payments will enjoy higher levels of customer loyalty.

_w=800_h=533_pjpg.jpg?v=20230522122229)

Guest Post: Who’s really responsible when travel payments go wrong?

When we ran the State of Travel Payments 2022 survey we asked passengers across five countries about their experiences related to paying for their holidays including bookings, payments and refunds.

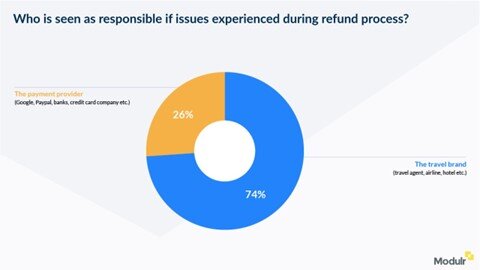

While doing so, we came across one statistic in particular that we’ve already seen more reactions to than others.

That’s because it raises some pretty big questions and conversations and, on some levels, raises some understandable defences.

It’s this:

Now, as a payments provider, we don’t think this is entirely fair, particularly in travel.

The travel industry is one of the most complex areas that we work in. Not many industries have to deal with the level of complexity of supply chains in quite the same way as those in travel, and that’s before getting into the complications that multiple currencies involved in a single transaction can raise.

But customers don’t know that. Because the part of the process they see is, for the most part, limited to their payment experience, it all looks far more simple than it actually is. Unfortunately, customers generally don’t care either.

Because of the amount of competition and options that customers now have when they’re booking travel, they’re not as likely to stay with the providers they’ve used before if their standards aren’t met. 74% say they’re shopping around and looking for better deals.

It’s also worth remembering that this wasn’t just an issue during 2020 and 2021. While we’re seeing a higher number of bookings and flights, COVID is still causing issues and the number of flight cancellations are still making headlines in the UK and around the world.

Why refunds are still a sticking point, and how payments can help shape your customer experience

While you’ll have to wait for the research to come out to see more details, it’s fair to say that the length of time refunds take isn’t matching up to customers’ expectations.

(And if you do want to see the research, there’s good news – everyone who registered for the Travolution Europe Summit will be exclusively sent a copy before it’s officially released.)

We understand that a customer’s expectation around refunds does not necessarily reflect the reality.

It’s difficult for everyone in the supply chain who has to wait for someone further down the line to refund them. OTAs sometimes have to wait on airlines and hotels so it’s further complicated with aggregators in the chain as well. But it’s not all bad news.

If you’re building a customer-centric process, you’ll be rewarded for it. In fact, 78% of customers say they’re sticking with a few trusted providers.

It doesn’t mean you’ll entirely avoid competition from others who do it well, but if you’re one of those few trusted providers, you’ll probably see customers coming back at a much higher rate than others.

Part of the reason we work so hard to keep payments moving quickly, and place particular pride in our reliability, is because we know that it’s representing you. If we have one piece of advice coming from the research right now, it’s to consider the payments infrastructure you use with your suppliers.

A good deal is only a good deal if it’s reliable. If your suppliers let you down when it comes to issues like refunds, then you may need to insist on higher standards in those you work with. Because payments are your responsibility say the customers.

Why Modulr wants to see more payments efficiency in travel

It’s one thing for customers to underestimate the level of complexity involved in payments and travel, but it’s another thing when payment providers do.

This is why Modulr operates as a one-stop shop for travel payments. With payments-as-a-service, you can innovate your payments ecosystem by eliminating inefficiencies.

The API-first Modulr platform puts all your payments processes in one place and gives you real-time oversight and easy automation.

As a regulated financial services provider in UK and EEA, a principal issuing member of both VISA and Mastercard, we offer multiple outbound payment services (domestic and international) and accelerated cards programmes, making it easier and faster to set up and manage your payment needs.

All of this gives flexibility and reliability to your suppliers, your customers and you.

If you’re going to the Travolution summit and want to speak to Modulr, book in a meeting now.

Kuba Zmuda will be sharing more insights from the 2022 Modulr Travel Survey during the panel ‘Give us some credit: Harnessing the Fintech and Travtech revolutions to rebuild trust’ at 9.05am BST at the Travolution Summit.